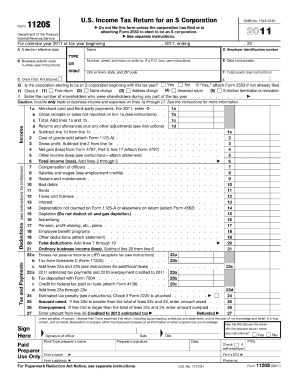

Get the free 1120 pc 2010 form

Show details

Subtract line 3c column b from line 3c column a Gross rents. 3d Gross royalties. Capital gain net income attach Schedule D Form 1120. Form 1120-PC U.S. Property and Casualty Insurance Company Income Tax Return For calendar year 2010 or tax year beginning Department of the Treasury Internal Revenue Service Check if Consolidated return attach Form 851. Do not reduce it by any deduction on line 36b Schedule A. Form 1120 Uncertain Tax Position State...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 1120 pc 2010 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1120 pc 2010 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 1120 pc 2010 form online

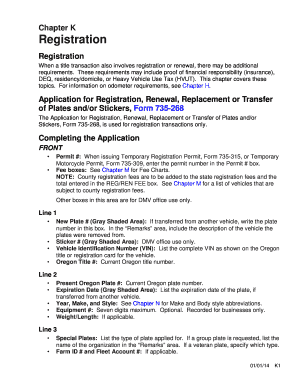

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 1120 pc 2010 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller. Try it right now!

How to fill out 1120 pc 2010 form

How to fill out 1120 pc 2010 form:

01

Gather all necessary financial information, such as income, deductions, and credits.

02

Carefully read the instructions provided with the form to understand its requirements and how to properly complete each section.

03

Enter your business information, including the name, address, and Employer Identification Number (EIN).

04

Report your income by providing details of your business revenue, such as sales, services, and other sources.

05

Deduct any eligible expenses, including costs for materials, labor, utilities, rent, and other business-related expenses.

06

Calculate your taxable income by subtracting the deductions from the total income.

07

Determine your tax liability by applying the appropriate tax rate to your taxable income.

08

Consider any tax credits or adjustments that might be applicable to your business.

09

Complete the balance sheet by listing your assets, liabilities, and shareholders' equity.

10

Sign and date the form to certify its accuracy.

Who needs 1120 pc 2010 form:

01

C-corporations that operated as small corporations during the tax year and meet specific requirements.

02

Businesses that have elected to be taxed as a Personal Service Corporation under the IRS regulations.

03

Corporations with a fiscal year-end that aligns with the calendar year (December 31st) and have not changed this fiscal year-end in the past.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 1120 pc form?

The 1120 form is an IRS tax form used for corporations to report their income, expenses, and deductions. It is known officially as "Form 1120 - U.S. Corporation Income Tax Return."

Who is required to file 1120 pc form?

The 1120 PC form is used for filing federal income tax returns for a domestic professional service corporation. This form is specifically for professional corporations, such as those engaged in providing medical, architectural, engineering, accounting, legal, and other professional services. Therefore, professional service corporations are required to file the 1120 PC form.

How to fill out 1120 pc form?

To fill out Form 1120-PC, U.S. Property and Casualty Insurance Company Income Tax Return, you will need to follow these steps:

1. Provide basic information: Enter the name, address, employer identification number (EIN), and the start and end dates of the tax year.

2. Complete Schedule A: Part I of Schedule A requires you to report your net premiums written and earned for the tax year. Part II is for other income, such as investment income and gains from the sale of assets.

3. Fill out Schedule B: This section is used to calculate the policyholders' surplus account as required under section 815(b) of the Internal Revenue Code. Include details of surplus and policy liabilities.

4. Complete Schedule D: Enter any net operating loss deduction and other deductions, such as taxes, depreciation, and amortization.

5. Fill out Schedule H: Report any amounts related to policyholders' dividends, premium dividends, and retroactive reinsurance.

6. Provide information on Schedule T: This section is for reporting income, deductions, gains, and losses from dividends received, coinsurance premiums, unearned premium reserve, and other items.

7. Complete Schedule G: Report any foreign activities, including insurance premiums and losses.

8. Fill out Schedule P: This section allows you to calculate the deduction for dividends received from regulated investment companies.

9. Complete Schedule M-1: Report any adjustments between book and tax income, including reconciling net income and taxable income.

10. Provide additional information and signature: Enter any other required information, such as the consent to disclose tax return information, and sign the form.

Remember to review your completed Form 1120-PC for accuracy and ensure that all necessary attachments and schedules are included before filing it with the Internal Revenue Service (IRS). It is recommended to consult a tax professional or use appropriate tax software to ensure accurate filing.

What is the purpose of 1120 pc form?

The 1120 PC form is used by corporations to report their income, deductions, gains, losses, credits, and to figure their income tax liability. It is specifically designed for regular "C" corporations, also known as "general corporations" or "for-profit corporations." The purpose of the form is to provide the Internal Revenue Service (IRS) with information regarding the corporation's taxable income and any associated tax liability.

What information must be reported on 1120 pc form?

The Form 1120-PC, also known as the U.S. Corporation Income Tax Return for Personal Service Corporations, is used to report the income, deductions, gains, losses, credits, and other relevant information for personal service corporations (PSCs).

The information that must be reported on Form 1120-PC includes:

1. Identification details: The name, address, and employer identification number (EIN) of the PSC.

2. Income: Report all sources of income for the tax year, including service income, interest, dividends, rent, royalties, and other types of income.

3. Deductions: Deductible expenses incurred by the PSC to earn and maintain income. This includes operating expenses, salaries and wages, employee benefits, rent, utilities, and other applicable expenses.

4. Cost of goods sold: If the PSC operates a business that involves selling goods, the costs associated with producing or acquiring those goods.

5. Capital gains and losses: Report any gains or losses resulting from the sale of assets, such as property or investments.

6. Other income or deductions: Report any other income or deductions that are unique to the PSC's operations.

7. Tax calculations: Calculate the taxable income, which is the total income minus deductions, and then determine the tax owed based on the applicable corporate income tax rate.

8. Tax credits: Report any tax credits applicable to the PSC, such as foreign tax credits or general business credits.

9. Estimated tax payments: Report any estimated tax payments made throughout the tax year.

10. Tax due or refund: Calculate the balance due or refund owed based on the tax liability and any estimated tax payments made.

It is essential to review the instructions provided by the Internal Revenue Service (IRS) when completing Form 1120-PC to ensure that all necessary information is accurately reported.

When is the deadline to file 1120 pc form in 2023?

The deadline to file Form 1120-PC for the tax year 2023 is generally on the 15th day of the third month after the end of the tax year. Therefore, the deadline to file Form 1120-PC in 2023 would be March 15, 2024. However, it's important to note that tax deadlines are subject to change, so it's always recommended to refer to the official guidelines or consult a tax professional for the most accurate and up-to-date information.

What is the penalty for the late filing of 1120 pc form?

The penalty for the late filing of Form 1120-PC (U.S. Property and Casualty Insurance Company Income Tax Return) varies depending on the length of the delay. As of 2021, the penalty is calculated based on the number of months the return is late multiplied by the applicable monthly rate of the unpaid tax.

For corporations with average gross receipts over $1 billion, the monthly penalty rate is generally 5% of the unpaid tax liability. For corporations with average gross receipts of $1 billion or less, the penalty rate is generally 2.5% of the unpaid tax liability.

Additionally, there is a minimum penalty for late filing. For 1120-PC forms, the minimum penalty is either the lesser of $435 or the amount of tax owed. This minimum penalty is subject to adjustment for inflation.

It's important to note that specific penalty calculations may vary depending on individual circumstances, so it's advisable to consult the official instructions for Form 1120-PC or the guidance provided by the Internal Revenue Service (IRS) for the most accurate and up-to-date information.

How do I execute 1120 pc 2010 form online?

pdfFiller has made it simple to fill out and eSign 1120 pc 2010 form. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make edits in 1120 pc 2010 form without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your 1120 pc 2010 form, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an electronic signature for signing my 1120 pc 2010 form in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your 1120 pc 2010 form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Fill out your 1120 pc 2010 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.